Youthful Somali hawadalars from East Africa are complementing an age old informal financial practice with an odd piece of a new digital resilient tool – bitcoin.

This article is Part 1 of a 2 Part Series

The importance of informal finance arrangements is a reverberating theme across Africa. Informal doesn’t necessarily mean bad or evil or dirty, it’s just that rather than rely on the heavy hand of the law, some communities prefer to place their trust in reputation and social networks for all trade commerce and financial relationships whether offline or online.

Others, will turn to informal institutions of trade and finance when faced by adversity in an immediate harsh environment such as war, political instability, structural programs or lack of reliable services.

For example, the Igbo traders in Nigeria pulling on social networks to scale resilient informal enterprise in the face of political instability in Nigeria.

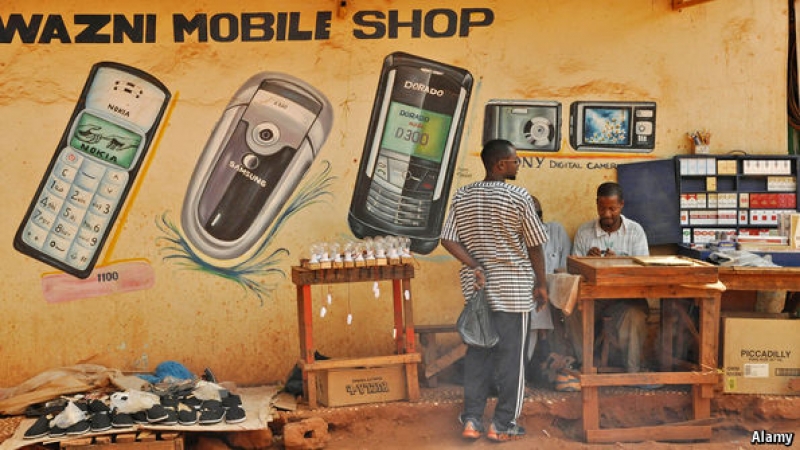

The early airtime currency traders of Africa who gave birth to mobile money like Mpesa tapped into the power of networks to fill a money remittance gap using an odd piece of technology.

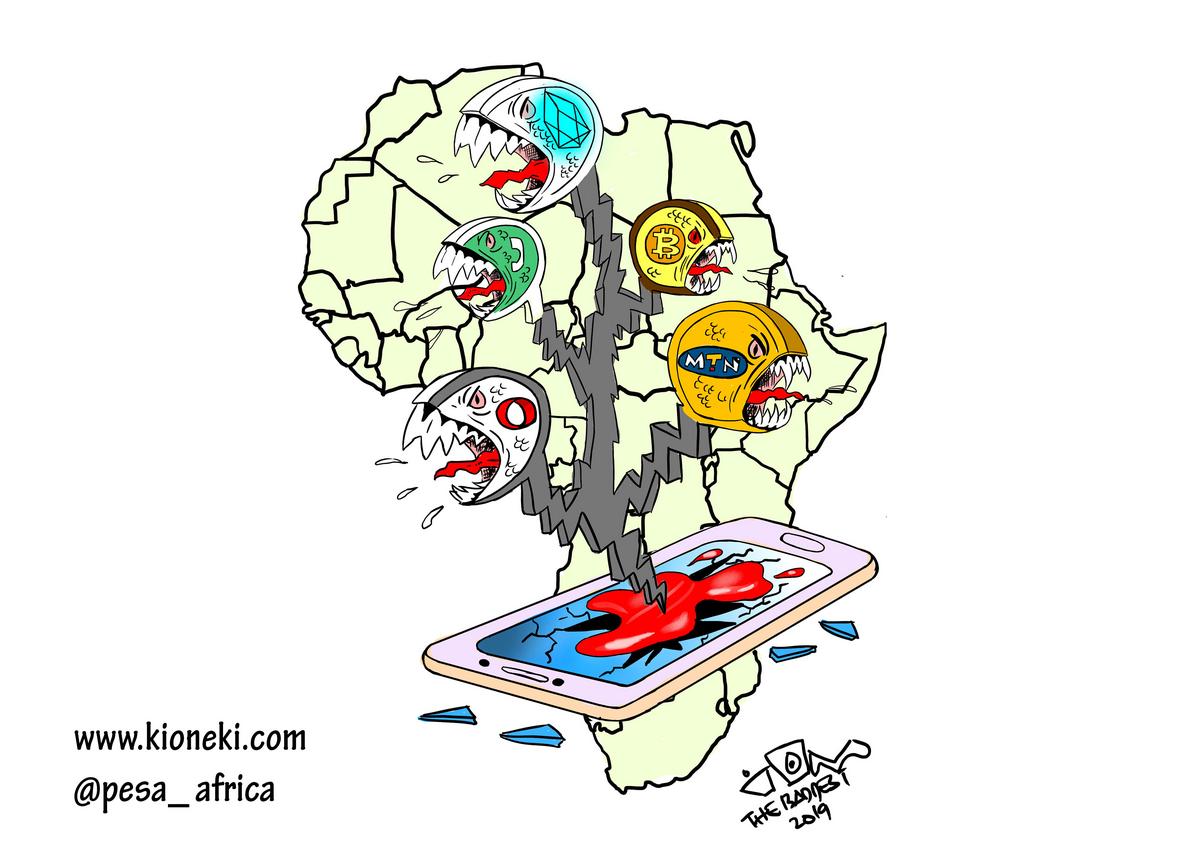

Today, the peer to peer Bitcoin traders of Kenya are bypassing an embargo by banks to meet demand for bitcoin by leveraging informal bitcoin trading networks based on trust and reputation.

It is all there.

One of the best case studies is of the Somali people, during post black hawk down cold war of Somali in the 90s by Peter D. Little.

Set in the early 2000s post war Somalia, his stories tells of the resilience of trade of livestock across the whole of East Africa despite the collapse of central government and no functional system.

The Ethiopia Somali Kenya cattle trade flourished in spite of the failed state conditions, on the back of trust network built on kinship. Through informal financial instruments and contracts of exchange and trade, they were able to sustain demand in Nairobi, forming a key trading corridor network in the Horn of Africa

In the post digital, post mobile world of 2019, the Somali people of little Mogadishu are under a different kind of threat on their digital financial lives.

Digital financial surveillance is underway in Kenya as part of tax reforms by revenue authorities including mandatory monitoring of electronic transactions and taxes on the digital economy.

Kenya is under pressure to reform after taking on too much debt to fund infrastructure projects that haven’t quit materialized as planned. An economic slow down, high youth unemployment rates and the weight of repayments on sovereign debts are some of the symptoms of the times. Some commentators have likened the impending state of the times to the Structural Adjustment Programs of the late 80s to 90s which shaped much of what is today’s informal economy.

As we shall see, the Somali people are some of the most sensitive to threats of erosion capital. It is in their blood, a natural instinct to respond to invasive threats to wealth such as hawala networks to bypass strict capital controls.

This got me thinking, how will the Somali people weather a period of heavy monitoring, high scrutiny and low trust?

The the answer lies in Eastleigh, a bustling business district in one of East Africa’s capitals, Nairobi. Here, youthful Somali hawadalars are complementing the old informal financial practices with an odd piece of a new digital resilient tool – bitcoin.

While there is no war today, times are similarly tough, the only difference is that is all mostly digital.

This is Part 1 of a 2 Part Series on how the young Somali Hawaladars of little Mogadishu are shaping the future of bitcoin in Africa

Continue reading “How the Young Somali Hawaladars of Little Mogadishu are Shaping the Future of Bitcoin in Africa (Part 1 of 2)”